Introduction

The S&P 500 is an index of the 500 largest U.S. publicly traded corporations measured by their market capitalization. Although the S&P 500 was not established until 1957, the S&P Composite Index began monitoring 90 stocks in 1926. 1 From its commencement in 1928 to December 31, 2021, the average yearly return is 11.82%. Since 500 stores were added to the index in 1957, the average annual return through December 31, 2021, is 11.88 percent. As a percentage, a mutual fund's average annual return (AAR) reflects the fund's performance over a specified time frame. In other words, it is an essential tool for investors considering a mutual fund investment because it assesses the fund's long-term performance.

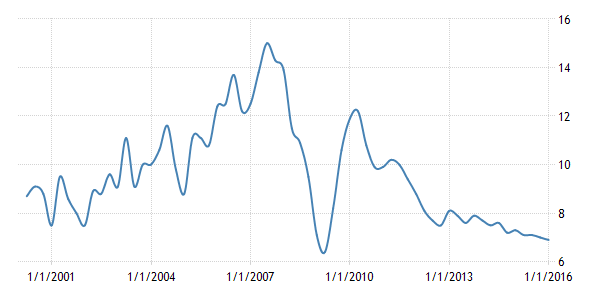

Average Stock Market Returns

When people talk about "the stock market," they usually mean the Standard & Poor's 500. Known as a stock market index, the S&P 500 is a compilation of the 500 largest publicly traded companies in the United States. (Major changes are made yearly, but the list is updated quarterly.) Although hundreds more stocks are trading on U.S. stock exchanges, the value of the entire stock market may be represented by the S&P 500 alone. This makes the S&P 500 a suitable proxy for the stock market's performance.

How Often Does the Stock Market Lose Money?

Even if there are years with negative stock market returns, the positive years have far outnumbered them historically. The S&P 500 Index, for instance, has a 10-year annualized return of roughly 12.1% as of March 3, 2022. The long-term average return takes into account multiple years of performance and may be very different from the actual return you obtain in any given year. 2 A stock market index may have increased over a decade yet decreased during any given year.

Market corrections and bear markets tend to get a lot of press when markets are volatile or suffering a period of negative returns. Generally, a market correction is defined as a decline of less than 10% from the market's last high point. Due to the possibility of a market recovery by year's end, negative total returns for the calendar year may not be reflected in the event of a mid-year market correction.

Stock Market Returns Vs. Inflation

In addition to providing an overview of average returns, the table above also includes valuable data regarding stock returns after accounting for inflation. An investment of $1 made in 1972 would be worth $46.69 today. $46 may not go as far today as it did in 1972 due to inflation. After adjusting for inflation, your $46 will get you the same quantity of products and services as $6.88 would have back in 1972.

Average Stock Market Return for the S&P 500

The average return on the stock market differs depending on the period, and the index used to represent the U.S. market. In most situations, the S&P 500 Index is used as a benchmark. A valuable proxy; however it has only been around since 1957. Fortunately, the S&P 500 can be roughly estimated using data from economist Robert Shiller, the Nobel Prize in Economics winner. It has been calculated that the S&P 500 has generated an annualized return of 7.58% since 1971, or 10.51%, when dividends are reinvested. If you keep your money invested in the S&P 500, you may expect an average 10% annualized return.

How Market Timing Affects S&P 500 Returns

The timing of an investment in the S&P 500 also plays a significant role in yearly returns. For instance, if you invested in the SPDR S&P 500 ETF Trust (SPY), which tracks the index, between 1996 and 2000, you would have seen a significant return on your money, but from 2000 to 2002, the fund experienced a consistent decline. Compared to investors who buy at market highs and then sell when prices drop, those who buy at market lows and either hold their investment or sell at market highs will earn higher returns.

The Stock Market And Long-Term Investing

Looking at the S&P 500's performance year by year over the past half-century, you'll see that the market has generally delivered on J.P. Morgan's predictions. Three consecutive years of heavy losses (-9.11 percent in 2001, 11.9 percent in 2002, and 22.2 percent in 2003) followed the April-November 2001 recession. Gain years like 1975 (38.46%) and 1995 (38.02%) have helped balance out these decline years. Long-term investing is so effective because of the lessons that can be learned by comparing performance over a single year to that over a more extended period. Although analysts and advisors can forecast a reversal or look forward to a prosperous year, anything can happen. There is no surefire way to predict market losses or gains.

Conclusion

Since its inception in 1928, the S&P 500 index has served as a proxy for the overall performance of the American stock market (in its current form, to the 1950s). Since its debut in 1957, the index is expected to return an annualized average of about 11.88% through the end of 2021. Although that seems like a good amount on paper, time is crucial; if you invest at the peak or cash out when prices are low, you won't see those gains.

Excel Can Help You Invest Better

Best Cash Back Credit Cards

Best Finance Magazines

Federal Direct Loan Program: Everything You Need to Know

How to Budget for Home Upkeep

A Guide to Business Payroll Taxes

Myths and Facts About HELOCs

What Are Bump-Up and Step-Up CDs?

How to Sell a Car When You Still Have a Loan

Navigating Your Mortgage During a Divorce: Key Decisions to Make

Apply for the Georgia Dream Homeownership Program