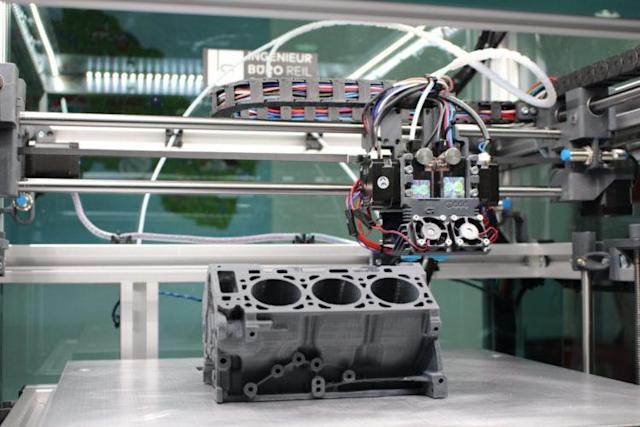

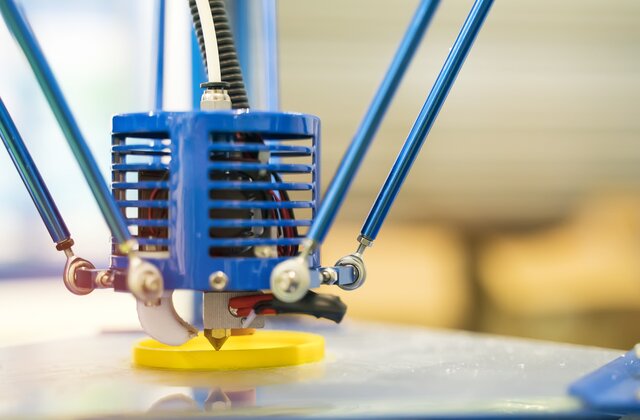

The industry of 3D printing is comprised of businesses that offer products and services capable of producing a variety of items. 3D printing, also referred to by the name additive manufacturing, produces physical objects using digital designs. The printing process is accomplished by placing small layers of materials made of powdered or liquid-based metal, plastic or cement and connecting the layers. While it's still too slow to be used in mass production, it's an exciting technology that has the potential to transform the logistics of manufacturing and management of inventory.

The market is so new that it does not have a benchmark index. However, this stock's performance could be compared with the overall market, as shown by the Russell 1000 Index. They haven't done particularly well. Stratasys Ltd. (SSYS), the highest-performing 3D printing company, has a dramatic underperformance of the Russell 1000, which has delivered a total return of -1.6 percent over the last twelve months. The market performance figure and the other figures in the table below are current as of June 2nd, 2022.

Best Value

They are 3D printing stocks that have the lowest trailing price-to-sales percentage. This measure can be used as a rough gauge of the worth of a business for businesses in the early stages of development or for industries that are affected by major shocks. Businesses with greater sales may eventually earn more profits when it reaches profitability. The price-to-sales ratio indicates the amount you pay for a stock for each dollar of sales generated.

Stratasys Ltd.

Stratasys provides 3D printers, like 3D printers, polymer materials, a software ecosystem, and other parts. It provides services to various industries, which include aerospace, automotive, consumer products, automotive, and healthcare. On May 31st, Stratasys declared that they have collaborated with NASCAR to develop the first 3D printed components that will be utilized in the entire range of NASCAR Next Gen race vehicles that will begin racing in the coming year. The parts comprise a cockpit air windshield ventilation system.

3D Systems Corp.

3D Systems offers many solutions for the 3D printing process. The business provides customers with various software, hardware, and materials developed with additive manufacturing. The goods and services provided by the firm have applications in various markets and fields, including the aerospace industry, the automobile industry, the healthcare industry, the semiconductor industry, and many more.

Proto Labs Inc.

An e-commerce-based firm that offers Digital Manufacturing service. Proto Labs offers 3D printing and injection molding of CNC machined metal sheets for fabrication. On May 6th, Proto Labs announced results for the quarter ending in 2022. These included 37.3 percent growth in net income and 6.9 percent in revenue year-over-year. Hubs bought in January 2021 aided in accelerating growth, posting a 78.6 percent growth in revenue year-over-year.

Fastest Growing

They are 3D-printing stocks that had the highest growth in sales YOY in this most recently reported quarter. The increase in sales could help investors find businesses that can increase revenue through organic or other avenues and identify businesses that haven't yet achieved profitability. Additionally, accounting variables that do not necessarily represent the company's overall performance could significantly impact the earnings per share. But, growth in sales can be a false indicator of the overall strength of a company because sales growth in companies that are losing money can be damaging in the absence of a strategy to achieve profitability.

Desktop Metal Inc.

It manufactures 3D printers and other equipment used to create complex components from metal. It also provides a 3D printing program. The company is a part of a wide range of industries, including consumer products, automotive education, and heavy industry. The two companies will create 3D printing sand-casting technology as part of a program that could cost up to $15 million.

Nano Dimension Ltd.

An Israel-based 3D printing business that focuses on creating tools and software for 3D printed, electronic devices. The company develops printers for Multilayer Circuit Boards and nanotechnology-based inks. The company provides services to various industries, including healthcare, consumer electronics, aerospace, and automotive. On May 17th, the company revealed that it was launching an annual share repurchase program where it would buy the equivalent of $100 million worth in the form of American depositary shares.

Best Performance

Materialise NV

Materialise is a Belgium-based supplier for additive manufacturing applications and 3D printing solutions. It is a service provider to many industries, including aerospace, healthcare, and automotive. Materialise announced its Q1 2022 results on April 28th. The company posted net earnings of $0.1 million in the quarter, in contrast to a net loss in the preceding quarter. Revenue increased by 16.3 percent year-over-year, driven by growth across all its operations, particularly manufacturing.

How To File Back Tax Returns With The IRS

The Best Capital One Journey Student Card Review 2023

Tax Implications of Owning Rental Property - A Simple Guide

Best Bad Credit Loans

The IRS Just Gave Gig Workers an Extra Year to Prepare for a Major Tax Change

What You Need To Know Before Putting Your Money In A Bond Mutual Fund

What Are Bump-Up and Step-Up CDs?

The Housing and Economic Recovery Act: Key Elements and Its Effects

Paying Your Taxes in Installments

Best Credit Cards With No Annual Fee

All About Annual Stock Market Returns by Year